GameStop, Robinhood & 2021

After a crazy year of 2020 and Coronavirus (Which isn't actually gone yet) we saw that plenty of folks overnight were convinced they knew how to handle a situation that many folks spent careers studying. We will see that again right now with my pathetic attempt to explain the situation with GameStop (GME) that is all over mainstream media.

I want to do this though because day after day on the week of January 25 to 29 I have to sit and listen to billionaires, hedge fund managers, CEOs and more talk about the retail investor. Why hasn't any news station interviewed a regular retail investor?

So let's get a viewpoint from a retail investor that tossed a couple thousand dollars into this circus.

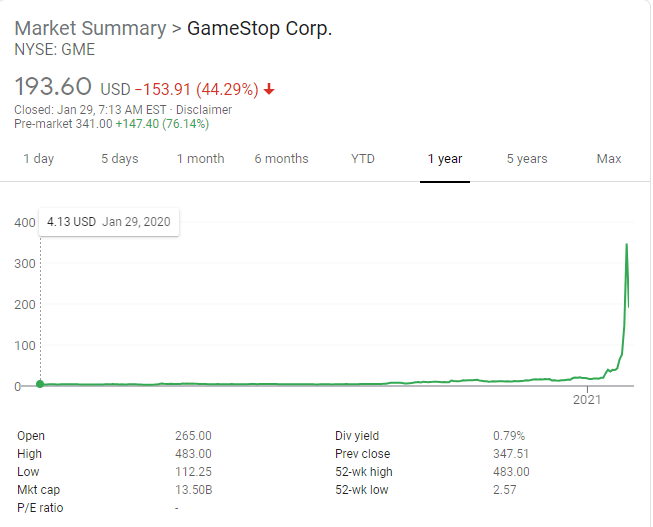

So let's start with what things look like right now typing this post. Of course GameStop has made quite a jump trading from around an average of $4/share to ~$200/share - what happened?

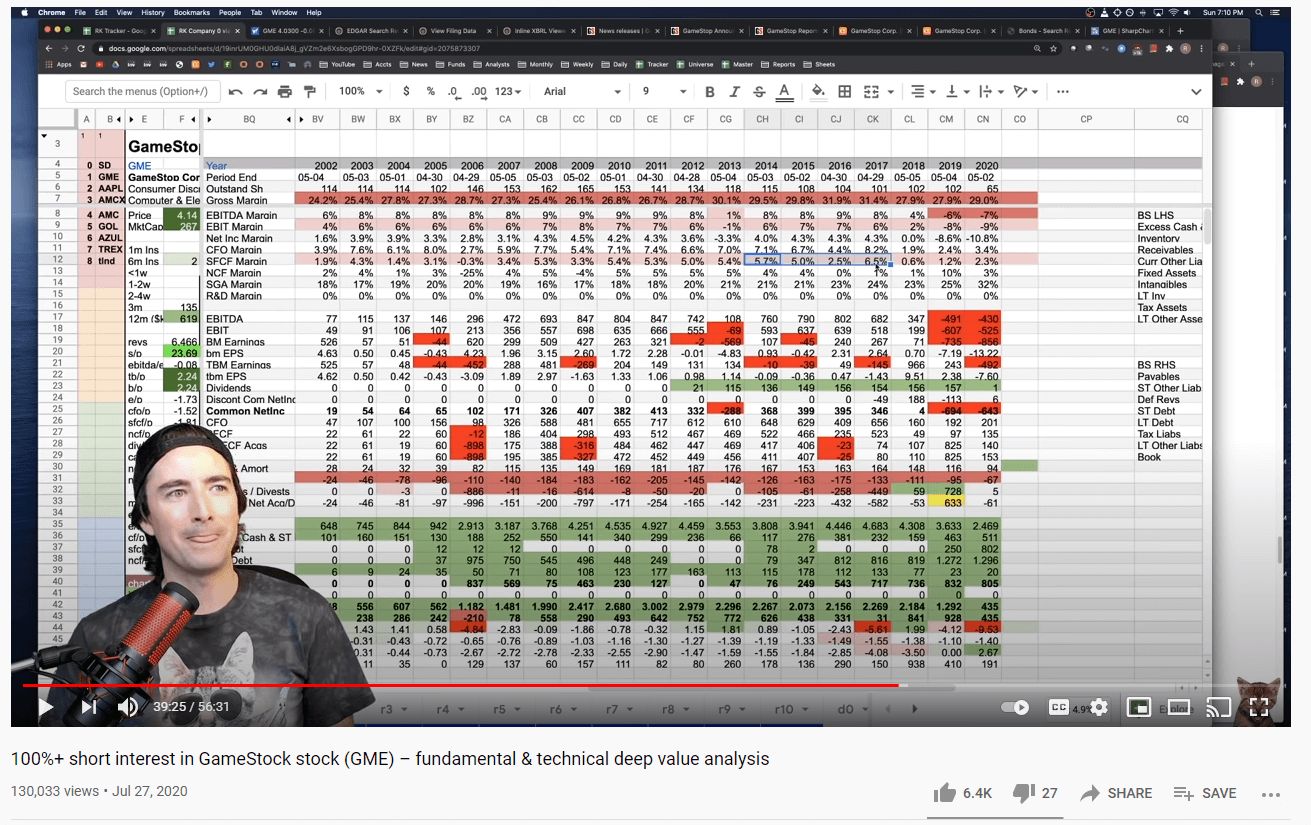

Let's roll back the clock to July 27, 2020 when a YouTuber known as Roaring Kitty decided to upload a 1 hour video going into the background of $GME and his research estimating at within 18 months a quick rise to GameStop.

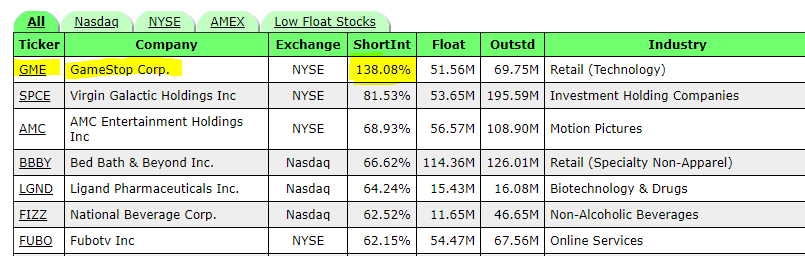

What caught my eye here is at one point in the video he shows some research/tool that shows GameStop is over 100% shorted.

For one - shorting a company to me seems so ethically wrong - you are basically making money on a company failing. For those unaware, let's do a basic example with pillows.

I borrow a pillow from you (the reader) and you want it back when you are back from a month long cruise. That pillow type is sold out so I sell your pillow for say $100. I'm hoping that those pillows will be available to buy before you return home. Turns out a new shipment arrives at my local store and I buy the same pillow for $50 just in time for you to return - I just profited $50.

Let's say they never got a shipment in time and the only pillow I could find was on Amazon for $300 so instead of profiting $50 - I ended up having to spend $300. As you see - the possible difference is infinite so risk is quite high.

Though we are in the stock market where the rules are a bit different. Some wealthy companies decided to short GameStop and sell huge lots of shares which they don't actually own! GameStop was trading around $5/share during the video above and a couple months later it was trading around $20/share.

If you are a large fund shorting GameStop - you are already in trouble. You are going to eat a lot to buy back the shares you borrowed. Though, a $15 difference per share isn't too bad, but those corporations are greedy - they refused. As more retail investors caught wind of this - they learned that large corporations had to buy the stock back in time - so why not buy more of it now? The continued buying drove the stock up to $20, $30, $40, $50 and then exploded to $200/share.

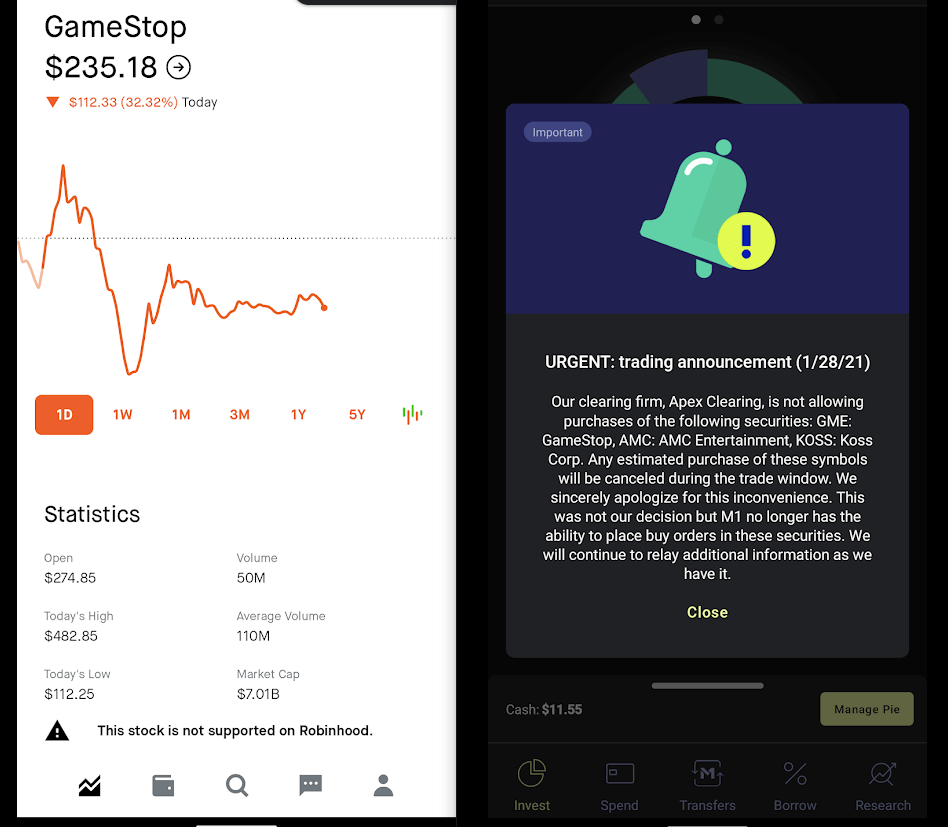

The companies weren't going to lose a tiny bit now - they might be losing upwards of $6 billion dollars. So of course this is corrupt America where heavy pockets make up rules as they go. The morning of January 28, 2021 was a rough one for retail investors.

Now I can understand the following:

- Removing trading on margin

- Removing instant deposits (margin)

- Removing partial share purchases

As all of these have inherent risk attached, but for me to sit with $2,500 in Robinhood with money that isn't margin and be prevented from using it how I want seems just plain wrong. I'm allowed to go to a casino and lose/win if I want, but god forbid I want to treat the market like a casino like every other billion dollar company does.

This to me is another field that is ripe for a wake up call. Gone is the era where knowledge was inaccessible and kept solely for Wall Street. One person can buy a few subscriptions and make educated decisions from their own research.

Though, let's go back to 2008 for a bit. Who got bailed out when families were losing homes, cars being repossessed and jobs being lost? I think everyone remembers the big business bailouts leaving the retail consumer to pick up the pieces. No one came around to help families - we collectively as a nation bailed out the hedge funds.

Those kids who were probably in middle school during 2008 have grown up and they have read and learn. Markets don't move based on actual merit of the companies anymore and it bugs me. Emails are sent, secret groups of big funds communicate in conference rooms and momentum pushes stocks up or down.

Yet, in strange instant where a couple million Americans stand up and start making their own stimulus checks - we have to close the markets and remake the rules.

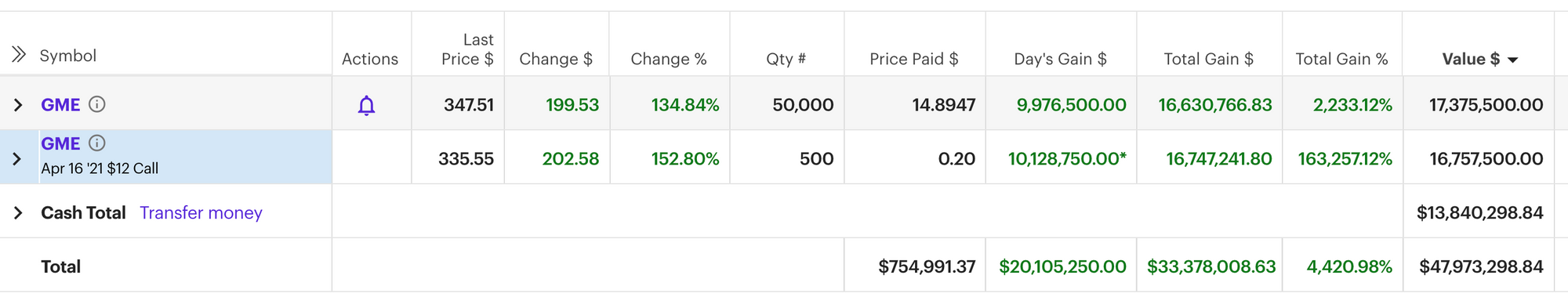

Roaring Kitty made a huge risk - putting down nearly $54,000 dollars into $GME, but he did hundreds of hours of research and his return was insane - netting nearly $34 million in profit. He hasn't sold the majority yet even as the stock tumbles down.

Are some folks hoping they can click a few buttons and get rich? Yeah and they will be hurt badly when they try to sell with the masses and no one is buying. The price will correct and fall.

This I hope when it's all said and done is a wake up call to big money and funds. If they try an outrageous play on shorting - someone will see and cause them to pay.