Credit Scores

At some point in your life - you realize you need to have a good credit score. A simple number that represents how well you pay people back and how much creditors should trust you.

They use a few different things to determine this, which boils down to:

- Amount of applications for credit

- Length of credit

- Remaining balances

- History of payment

A somewhat public, but complex formula then spits out a number between roughly 300 and 850 with 850 being as high as you can go.

3 companies have taken this responsibility to manage tracking American's credit and they are - Equifax, Experian and TransUnion.

You'll probably recognize Equifax as the company that failed to update a 3rd party dependency in a timely manner. This resulted in around 150 million American records being compromised including full names, social security numbers, birth dates and addresses.

I'm sure when I signed up for my first credit card one of the 44 pages of terms included that all my purchases would be shared with credit agencies. Much like my car loan and house mortgage.

So lets start with the stuff that bothers me about credit scores.

I got this email while I was living in an apartment for a service that would submit my monthly rent information to credit bureaus with the clause for a new monthly fee.

I'm sorry, but what? My rent was forced to be either a check or automatic bank draft which doesn't seem like a credit. This is just money being debited from myself so it doesn't even seem like it belongs. However, the newest FICO9 / VantageScore 3.0 score metric is now including rent payments if they are provided so what do I know. [source]

Not to mention, the benefit of RentPlus is they only report "on-time" payments. So this looks like you pay a company to shove under the rug anytime you have a late payment. This seems like it destroys the purpose of a credit score to me - just pay a company and they will back date your payments (only submitting the good) to the agencies. It also scratches my head since its expensive to be poor.

I froze all 3 of my credit reports after the looming stress of the Equifax leak. So I've decided to sign back into all these accounts and check in on them and boy this was a stressful experience.

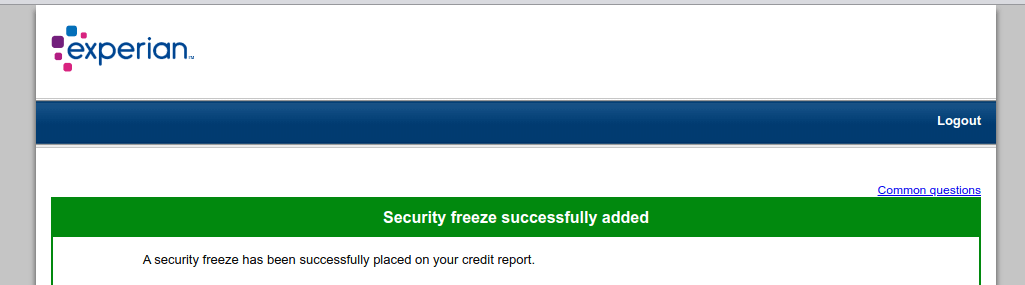

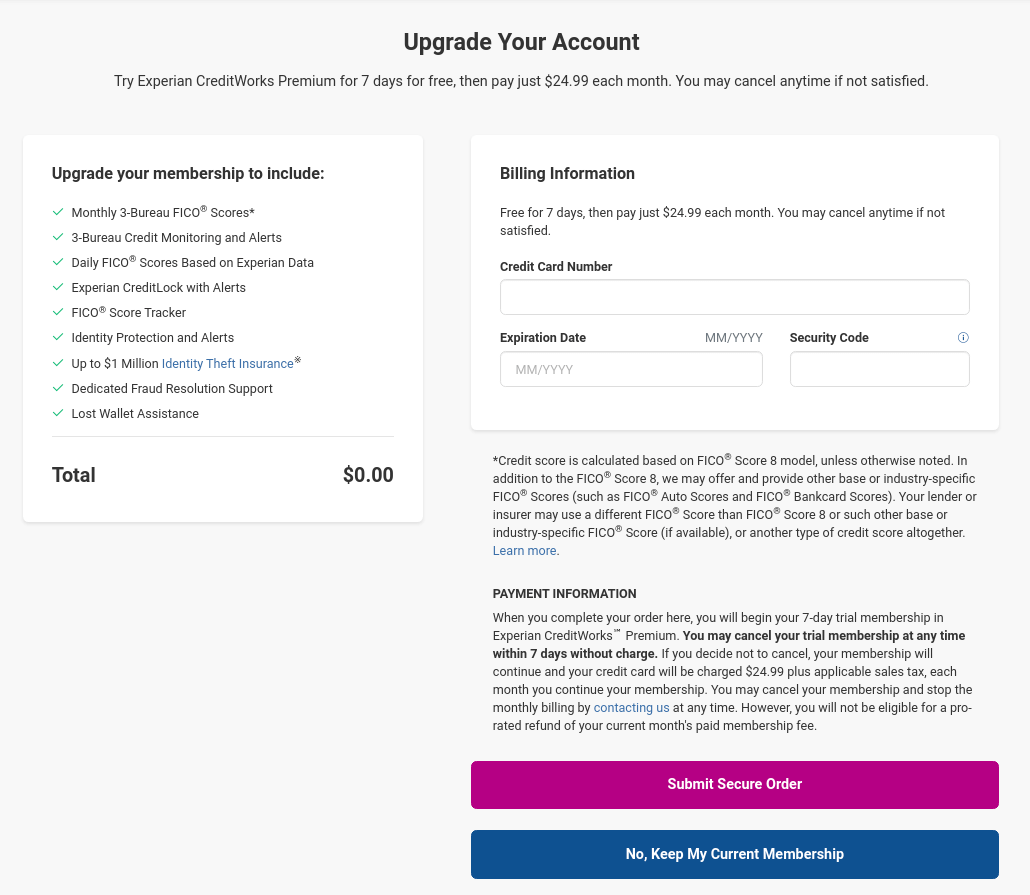

Lets start with Experian, I sign into my account and immediately redirected to this screen.

This is just a slap in the face. The buttons are confusing colors, there is a misleading $0.00 shown, but in fact its $25/month. I just want to check my freeze, which led to another deceptive tactic.

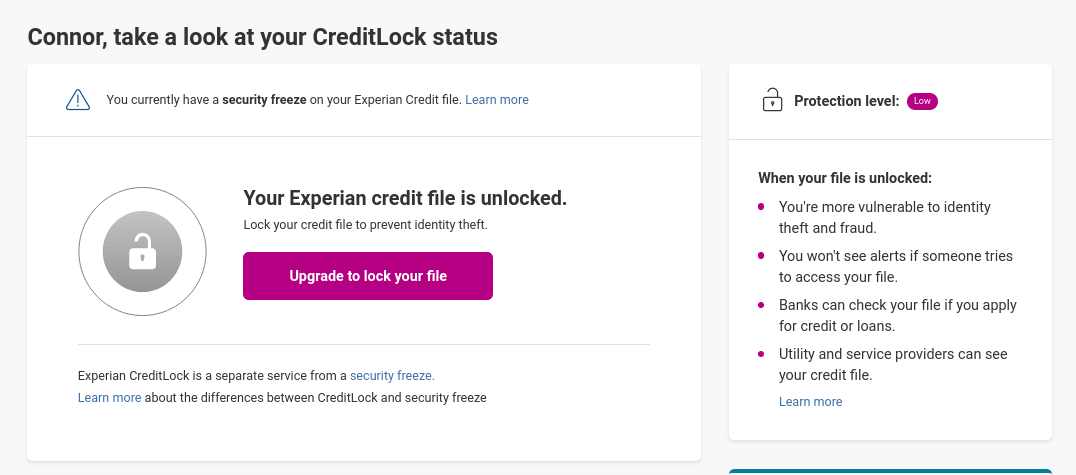

I stumbled trying to find a "freeze" section, but it was hiding under a CreditLock feature. It seems Experian just wants to take as much money from me as possible. They are showing this misleading "CreditLock" in front of my face, but hiding in tiny text that my legally free and required security freeze is still in place.

I'm happy my freeze remains but absolutely disgusted by all the deceptive techniques at play here. Someone older or less versed in reading through these techniques might find themselves thinking they need to pay monthly to protect their credit.

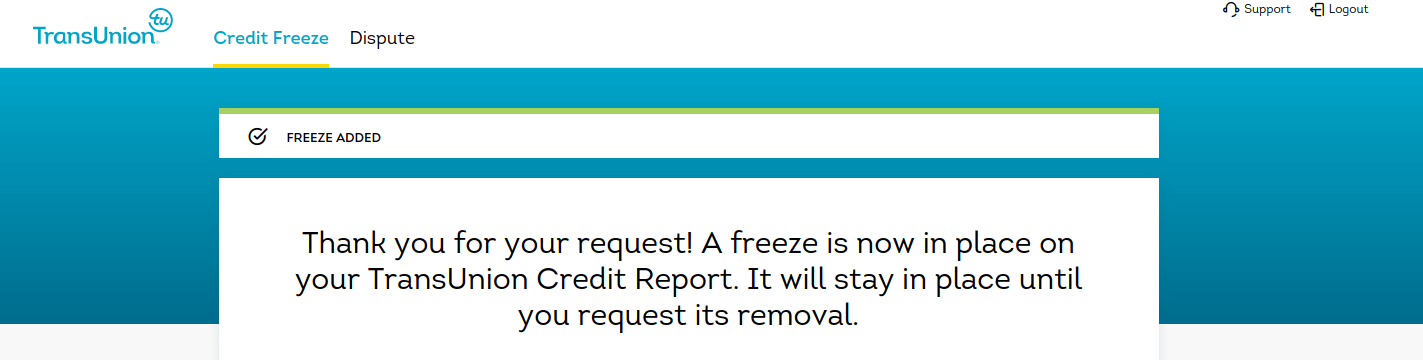

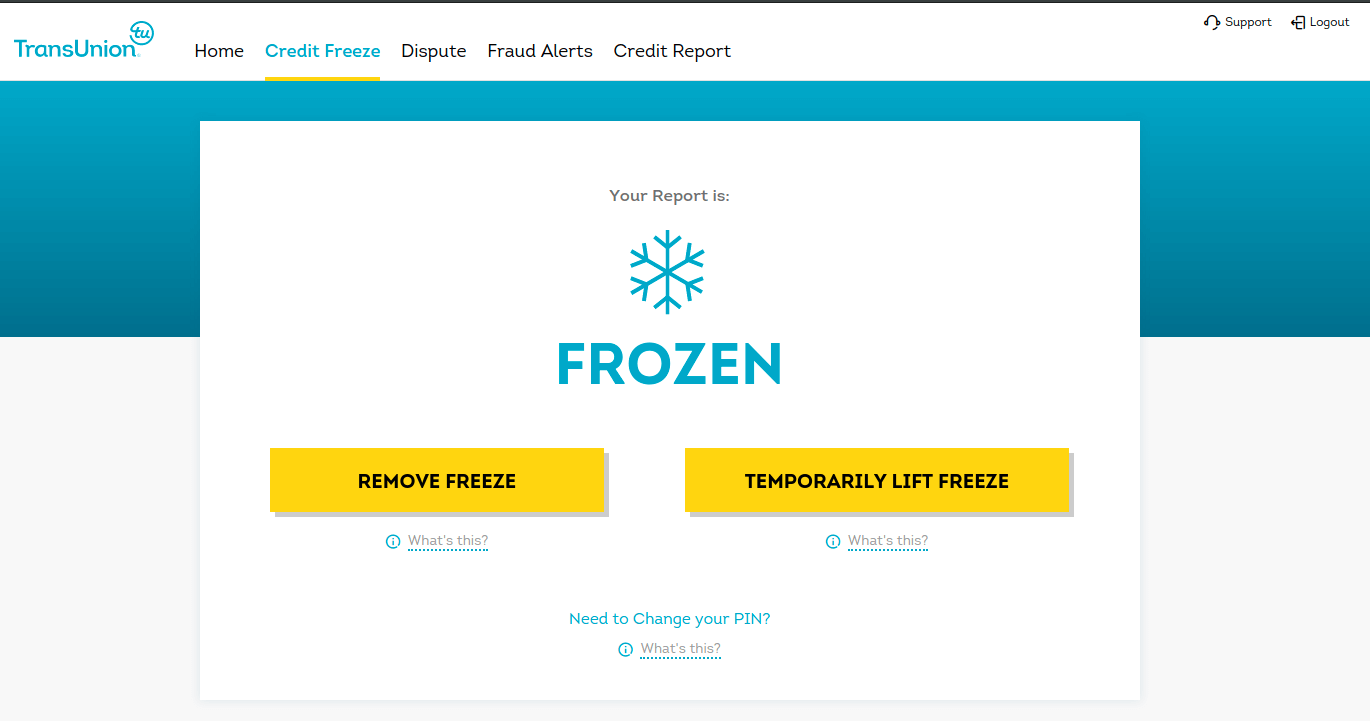

So off to TransUnion I go to check my freeze.

Finally a respectable company. An easy login flow with a clean interface and as clear as day navigation menu for where I need to go. My report is frozen and nothing was shoved in my face. If I go exploring I can find a similar paid option for more features, but it was presented in a calm manner.

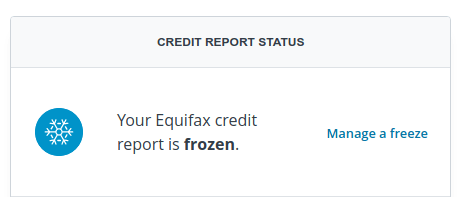

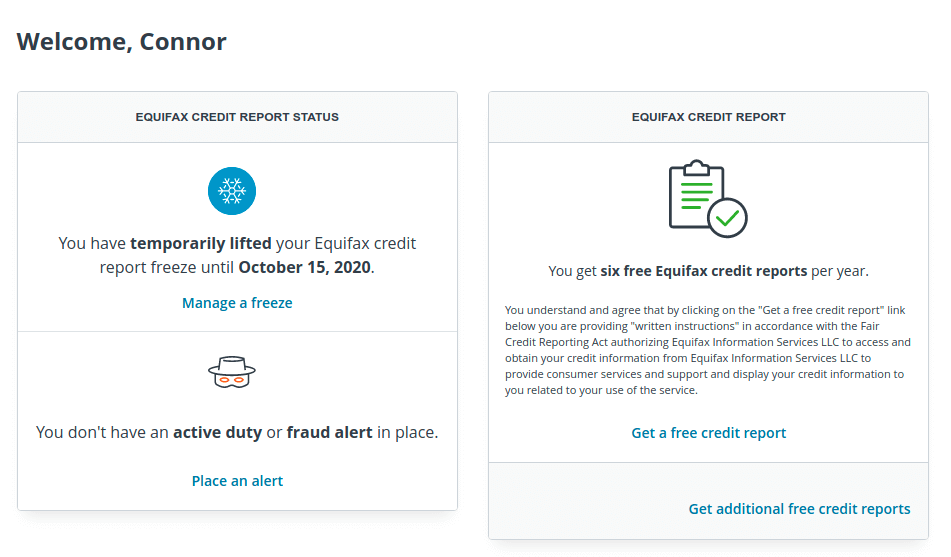

Lets go check the final one - Equifax, which I'll place between the two above in terms of the experience.

The good news with Equifax is my account overview page shows the status of my freeze. Why they choose to tell me about my temporary unfreeze from almost a year ago - I don't know.

The UI isn't as heavy as Experian in shoving paid products in my face, but it doesn't take long as every location outside of your account screen is trying to get you to sign up for some monthly plan.

This just bugs me. These companies hold insane amounts of information of each and every person and countless times in history - they've lost that information. Yet the solution to this problem for all of these companies is to pay them to monitor your information?

This doesn't make sense. I don't want any of these companies to hold any of my information, yet without them I can't buy a house or car unless I'm sitting on large amounts of cash. They are a necessary pain in this world and their deceptive tactics and inability to keep my information secure upsets me.

Next up, lets rant about how the information gets in here. For large companies like any Chase, Discover, American Express - they submit information to credit agencies because they exist in symbiotic relation where both companies need each other to survive.

Other smaller companies simply don't or leverage a paid service like I talked about above. So it seems weird to me that information about me that controls my life isn't actually submitted by me. This could be for the obvious reason that abuse may occur.

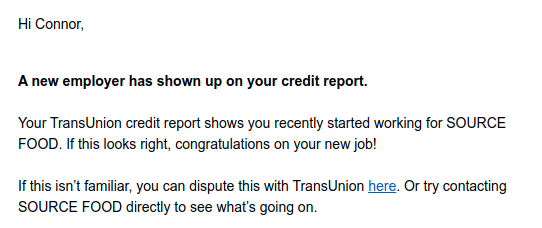

So imagine my surprise when I get an alert that a new employer showed up on my report. I was nervous beyond belief - I did not get a new job and this company name was eerily similar to my actual job.

Long story short after a painful process of submitting forms online and verifying information (despite having an account) I had to prove I worked at Sourcetoad and not SOURCE FOOD. This is because this information is used to build Knowledge Based Authentication (KBA) so I can be validated as myself without an account.

These are the classic questions you get like - which of these streets did you live at?

So I either run the risk of having incorrect information in my profile or having to do the stressful process of correcting information in a credit report. This is all because the cars salesman who sold me my car failed to transcribe my hand-written form of required questions.

The car industry hasn't evolved to a more digital tablet information gathering, but this is an expensive transaction and this is my credit at stake here. Would it hurt to verify information or double check it before sending it onward to credit reports?

As you can tell - I didn't have the best car experience. After being told that the many credit hits would just count as 1 hard hit - I still have 3 hard hits in my report. Deceptive lies everywhere and an industry that can't step sending letters to entice me to sell my car not even a year later.

Finally, credit scores evolve with the changing times that work sometimes for or against you but some industries refuse to change.

The mortgage industry is a great example that mainly use FICO 2/4/5 which are specific scores built for the mortgage industry. Those scores won't look at a rent payment that is 3x your proposed mortgage for 5 years, but they'll make sure they take the credit bureau with the lowest score instead of averaging them all.

I don't like any of this. I paid everything off debit for years until it started biting me for not having a credit history. Now I need to keep credit cards and pay them off, because its the American way.