Adult Life & Mortgages

Way back in October of 2020 I purchased my first home and left the apartment life behind. It was an exciting and nervous time as I paid out a down payment and moved more money at once than I'd ever done before.

Who knew how many scams and spam I would get sent to me directly after the creation of a new loan.

- The "Environmental Water Resource" scam

- The "Welcome Gift" scam

- The "Mortgage Life Insurance" scam

All this taught me was to ignore most things that arrived in my mailbox and I even blogged about that experience of collecting 3 months of mail. Some of these letters are pretty convincing much like the evolving landscape of scams. I wish we had a class in school that helped just run through big life choices (car, house, etc) and run through common scams and how those transactions commonly work.

Take for example my first mortgage as I was closing in on my first house purchase. They explained to me an escrow account and it was the first time I'd heard of it. This was going to be a chunk of money managed by the lender that I paid forward to help cover things like home insurance & taxes.

It sounded pretty cool - a few less things to manage payment for and it was built into my mortgage payments. Whether those costs were pass through or ended up being used to fund this enhancement - I don't know. I do know it was a requirement with my lender to utilize this escrow. I'm guessing its in the lender's best interest to ensure some of the heavier yearly fees are covered especially when it comes to the changing landscape of taxes and insurance.

It seemed having a mortgage wasn't bad at all - you just pay and some dependent things are automatically paid on a schedule. Not to mention when you consider your monthly mortgage is basically half what you paid renting month to month - the low interest mortgage payment is an attractive way to live if you can sustain the every once in awhile large payment to fix something.

This wouldn't be a blog post though if it was all fine and dandy - so lets talk about what happened when my lender decided to sell/transition my loan to a new provider: Newrez.

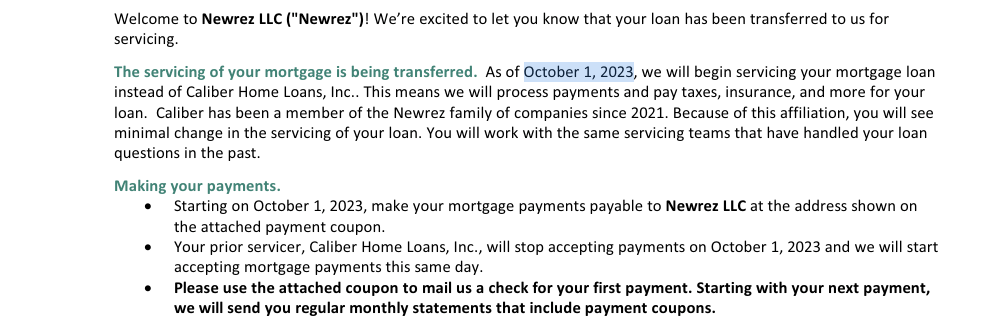

Prior to October of 2023 I get the above letter and email about this transition explaining everything is getting transferred.

I don't really think too much about it - my information transferred including my auto-pay and sure enough on October 1st 2023 - my monthly payment was pulled with no issue. A month later I got an email about my taxes being paid and I figured all was okay.

Turns out I was far from right and should have triple checked everything the instant my loan moved companies.

In December of 2023 just a few months later - I get a letter in the mail that says.

Our records show that your hazard insurance expired and we do not have evidence that you have obtained new coverage. Because hazard insurance is required on your property, we plan to buy insurance for your property. You must pay us for any period during which the insurance we buy is in effect but you do not have insurance.

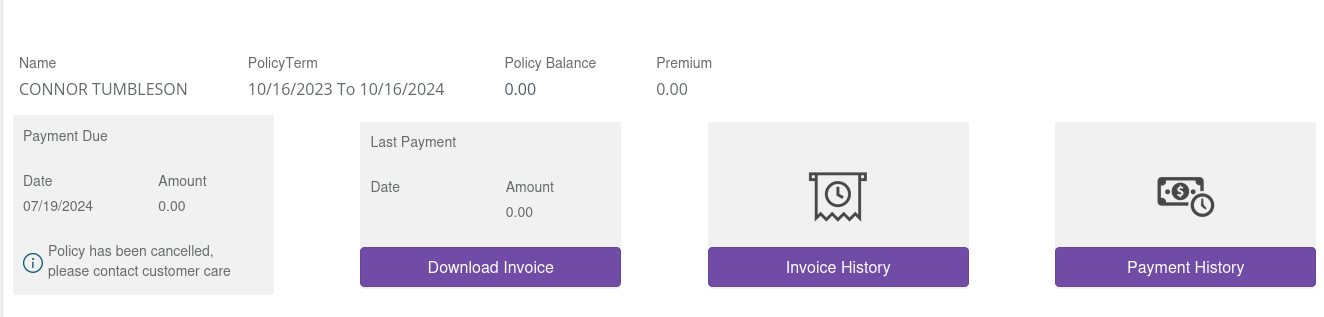

I was very confused because my home insurance was still active and the panel (Heritage) where I can review it was in good standing. So I emailed my insurance agent explaining this and they faxed over my policy back to Newrez.

This is where a mistake occurred - turns out when all these parties were talking to each other - my home insurance still did not get paid. However, it did get loaded into Newrez so I was no longer in danger of getting "forced insurance". In the moment I wasn't looking into whether it was paid or not, but whether my lender knew about it.

So I thought and believed everything was alright until July of 2024 when I checked my mail and had a letter from my insurance saying it was cancelled. I was quite alarmed at this and waited for business hours the next day to call Heritage.

Heritage picks up and is way more friendly and quicker than the staff at Newrez and we get to work. They understand the story, but there has been a gap due to unpaid coverage and with immediate payment and some document proving I had no claims in the uncovered time - I could reclaim my coverage.

I'm excited and loop in my insurance agent to help me with that document. I prepare a credit card for immediate payment as I don't trust Newrez to dispatch a payment and sadness rolls in.

The staff member mentions the effective cancellation date was 10/16/2023, so even with an active payment in early July 2024 - it will not work. She gets confused on the call and asks for a hold - how could I react to something when I only get notified in mail when it was already cancelled?

The hold is over and apparently "the system" is unable to accept payment for a cancellation dated more than 90 days old. I'm getting flustered now and trying to explain the moving of loans and lack of any notification of missed payment. I'm getting flustered with Heritage who sent me a notice back-dated preventing me from even solving this myself.

They won't budge and apparently I've escalated as high as I could go, so I give up and contact my lender again. They now know my insurance is cancelled and I'm back in this situation of getting lender forced insurance which is easily 3k more a year than my last.

So now I'm back to contacting my insurance agent to find a different carrier after they tried themselves to get the old policy back. Turns out trying to get insurance in Florida during hurricane season when you have an accidental gap of 7-8 months of missing coverage makes this very difficult.

I will survive this with a bit of extra money spent and hopefully when things calm down - my lender will accept fault and meet me half way with this difference of cost. Going forward I learned to never put too much faith into corporations that can dictate a solid amount of stress for yourself.

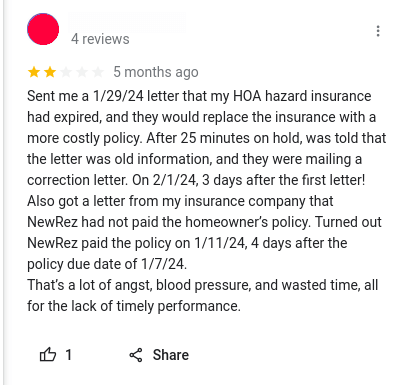

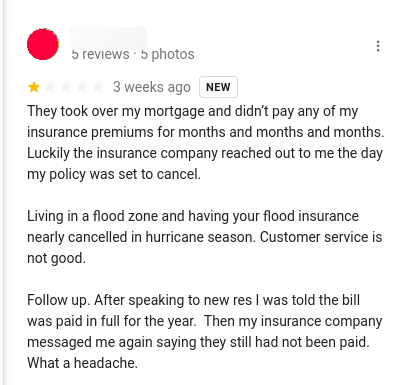

So I went off to leave a bad review and I guess I wasn't alone.

Now I'll look into how to manage paying for my own insurance and taxes (aka without escrow) as I'm not risking this again.